Workers compensation audits are part of being in construction but they can go bad if you aren’t ready

For most construction companies, meeting with a workers comp auditor (either remotely or in person) each year is normal. It can create high anxiety for those of us that have had bad experiences in the past or simply are not prepared for the audit. These audits are required to reconcile the audit period and will typically result in either a bill for uncollected premiums or a credit for overpayment. After 18 years of being on the contractor side of these audits, I have created a checklist of common items to have ready along with some tips so the audit is simple and doesn’t get out of hand.

In this blog post, I’ll share what I have learned.

How to prepare for the audit

Your auditor will contact you to arrange for the meeting. Most audits occur a month or two after the policy period ends. They will typically send an email with a list of the items they want you to have on hand. If you need more time to gather up the required information, ask for a new appointment. Make sure you start early on gathering up this info as you don’t want to go into the audit with missing information. It will lead to an extended process of having to send it to them later which can allow them to make decisions without your input. Note: if you are asking someone else to gather up this information, make sure they are someone you trust with very sensitive information. This information should be kept confidential.

Here is the checklist of those common audit items most auditors ask for:

- Payroll Reports: Gross Payroll Summary by employee, showing all wages and compensation for the audit period.

Tip: if you use Quickbooks, use the “Payroll Summary Report” and print it per calendar quarter so it can be compared to the Federal 941 forms.

- Employee List: Names and job duties of each employee.

Tip: Do this list once and keep it handy for future audits….a quick update each year is easier than starting from scratch. For office staff, keep it simple for the job duties (eg. filing, invoicing, phone calls). You want to be careful not to trigger a higher classification code due to some job duty that someone rarely does. Think of it this way, they are looking for exposure to risk. The tasks and job duties will tell them if they are exposed to job site risks or not.

- Ownership: List of Executive Officers, Owners or Partners (Ownership %, Amount Paid, Job Duties & Titles)

Tip: keep this list handy for future audits….A quick update each year is easier than starting from scratch and this list will not change very often.

- Tax Forms: Federal (941) & State Quarterly Reports that correspond to the audit period.

- Sub List: Subcontracted labor by name, amount paid, job duties, & copies of WC certificates of insurance for the audit period. In some cases, they ask for the 1099’s of all subcontractors to pull names and randomly check certificates. If you subcontract out a lot of work, make sure you are collecting and filing copies of workers comp certificates in a file or binder for quick reference during the audit.

- Financials: Profit & Loss Statement or General Ledger Summary showing total gross sales for the audit period.

- Timecard samples: Typically three time cards for at least two workers during the audit period. These time cards need to include: Start time/End time, start of break, end of break, regular time hours and overtime hours and it must have the employee’s signature on the time card showing they accepted it. Check out our “Perfect Construction Timecard Template” to make sure you have all the items covered.

- Overtime sample: Check register or check stub for one employee showing name, rate hours, and pay for both regular and overtime. Check dates must be within the audit period.

Know your audit period….it may not be the same as your policy period. If audit dates don’t match calendar year quarters use this guide to help understand how to add/subtract months from the quarters.

Audit Day

Think of the auditor like a city inspector. They have many appointments each day and can get annoyed by those that are not prepared. I have found the best audits are the ones where I have the needed info and I get them in and out as fast as possible. Some of what the auditor does is subject to their interpretation of your business and work performed. You don’t want to give auditors more reasons to ask more questions which can lead to bad outcomes.

Keep it Confidential

Workers Compensation audits require sharing many confidential items including pay rates, financials among other items. Setup the auditor in a private room where the doors can be closed. I use a small conference room that is fairly soundproof. This allows for private conversations with the auditor about the confidential information being shared. I take the extra step of even reminding the auditor that I don’t want the payroll or other sensitive information to be left out in plain sight.

Here is my audit day strategy:

- Greet the auditor in a friendly manner. Getting aggressive with them will not help….remember, they are just doing their job.

- Set them up in a private place that they can use their laptop and go through the paperwork.

- Provide what is requested but nothing more. When you first meet with them, ask them what they would like to see first and give them just that. I don’t bring in all the reports and just dump them on the table. It’s better to give them item by item as they request it. Sometimes they decide they don’t need all of it.

- If you don’t have all of the reports, you should have some time while they are setting up their worksheets to gather it up any missing items. I usually wait to give the time cards or overtime sheets until they ask. Sometimes they say “give me two time cards for the months of _____” and “give me three certificates for subs you have used”.

- Keep it friendly. Offer them water or coffee. Nothing is worse than an upset auditor who can make it so much harder on you.

- Remember the goal. You want to get them in and out with as few outstanding questions as possible so they can submit their report. This will save you time and maybe even some premiums.

Summary

Workers comp audits are not easy but they don’t have to be a disaster. If you are prepared with the information they need and keep a friendly tone with clear, concise answers to the questions, it will go much smoother and result in a better outcome. Don’t forget to keep it confidential as well.

Resources

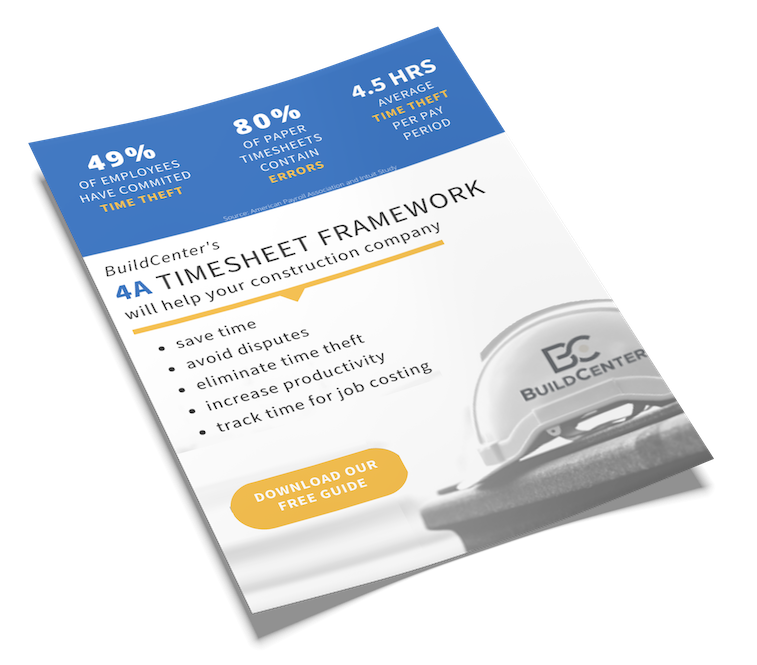

- Download our “Perfect Construction Timecard Template” to ensure all the info is compliant with workers comp auditors.

- Try BuildCenter to streamline your entire construction business.